Hey there, Small Movers,

In addition to my weekly post, which I plan to release on Sundays, I thought a midweek reminder of the latest action items might be helpful.

This newsletter is all about taking small, consistent steps that have the potential to create meaningful financial progress over time. You all keep me accountable, and I’m happy to do the same for you.

Additionally, I added a “Worth Your Time” section. While I am not a financial advisor, portfolio manager, accountant, or attorney, I follow many professionals in these fields. I thought it might be useful to share some of the most interesting perspectives I come across.

What’s been catching your eye?

Feel free to share other articles or podcasts in the comments—I’d love to learn from you!

—Meredith ❤️

Reminder: Action Steps

Please take the New Reader Survey

It’ll take you about 1 minute, and your responses are completely anonymous—I won’t be able to link them back to any individual. Your input will help me prioritize content that’s more relevant to you! 🙏

Worth Your Time

DeepSeek FAQ. Ben Thompson writes a detailed analysis of DeepSeek’s R1 Model. On Monday, freaked out investors sold Nvidia down 17%, wiping nearly $600 billion off its market cap, the largest single day loss in history. (Stratecherry)

Did China Beat the US at AI? My former colleague, former #1 fund manager Emmy Sobieski, put herself through programming bootcamp and “learned about the biggest thing that has experts worried about AI today: How AI is already programming itself in ways we don’t understand.” (Emmy Sobieski)

Understanding DeepSeek’s Role in AI Evolution as presented by my former colleague Brad Neuman’s AI Avatar, which is freakishly good. With his experience as a telecom analyst in the 2000s, Brad explains Jevon’s Paradox and how AI growth may be supported by improvements in technological efficiency. (Alger: 1 min.)

At the Money: Lessons in Allocating to Alternative Asset Classes with Barry Ritholtz and Ted Seides answering questions like: “How much capital do you need? What percentage of your portfolio should be allocated?” (Masters in Business: 16 min.)

An anthropological overview of various investment tribes. My former colleague and portfolio manager Patrick Rudden describes the psyches of equity investors vs bond investors: “The reason I find this tribal taxonomy useful is because I can look at how each tribe is pricing things and get a read on whether they are positive or negative.” (Patrick Rudden)

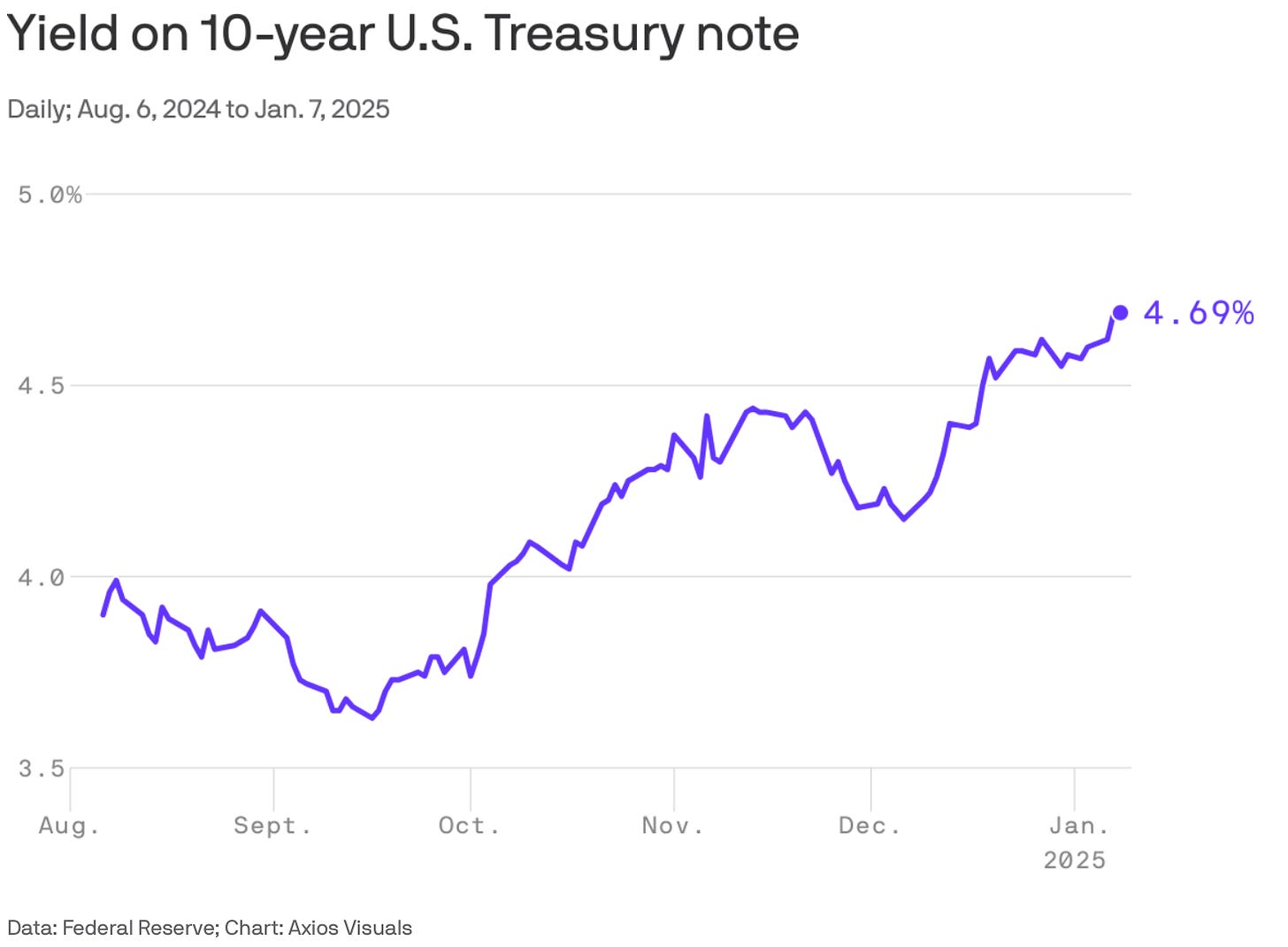

BofA's Savita Subramanian on The New S&P 500: AI-Driven and Asset-Light | #567 has a wide-ranging discussion with some takes others may think crazy: “I think it's the idea that we could see real rates continue to rise, and stocks are gonna do just fine. I mean, I think it's the idea that, you know, everybody thinks that, like, 5% is some kind of, like, witching hour number where the market goes to zero. I don't know why we all think that.” (The Meb Faber Show: 62 min.)

1 big thing. The bond market’s warning. “With rates higher, any given deficit-expanding policy will come at a higher cost—in terms of interest expense and higher rates—than it did when Trump was last in the Oval Office.” (Axios Macro)

America Needs to Radically Rethink What It Means to Be Old by Jonathan Rauch: “With millions of people living vigorously into their 80s and beyond, the very idea of “retirement”—the expectation that people will leave the workforce at an arbitrary age—makes no sense.” (The Atlantic, gifted article link)

How much wealth does the American middle class have? “The wealth of the American middle class has fluctuated over the past several decades, growing steadily from the late 90s to the mid 2000s before declining after the 2008 financial crisis. Around 2012, middle class wealth began to recover, reaching a peak of $499K in 2022—a 60% increase from the 2012 low of $313K.” (USA Facts)

Upcoming!

Substack Market Forecast Summit on Friday, January 31st. The event will feature live video conversations exclusively in the Substack app, where top finance, business, and economics publishers and analysts—Adam Taggart, Matt Taibbi, Danielle DiMartino Booth, Dan Denning, Noah Smith, Compounding Quality, James Lavish, CFA, Matt Stoller, Dr Pippa, Sam Ro, CFA, Emily Sundberg, Michael Howell, Eric Newcomer, Kevin Muir, How They Make Money, and more—will share their insights on everything from opportunities and risks in 2025 investment strategies to the broader economic outlook and market trends.

Disclosure

This newsletter is for informational and recreational purposes only. Any investment products mentioned are for illustration, not recommendations. Always do your own due diligence. Past performance is no guarantee of future results. Meredith Genova is Director of Marketing for AMG National Trust. All opinions expressed are her own and do not reflect the opinion of AMG National Trust or its affiliates.